To create a universal effect on the system of optical production, the 5G revolution is calculated and this system of optical production is progressing in the basic structure of 5G systems. Moreover, the arising 5G commercialized placement will generate significant fresh market possibilities for fiber optic wires, fiber optics and further higher-speed network optical productions.

5G Encourages the Development of 25G/50G/100G/200G and 400G Optical Transceivers and IC Chips:

5G rebuilds the radio remote unit (RRU), the 4G baseband unit (BBU), distributed unit (DU), antenna into centralized unit (CU) and active antenna unit (AAU), which establishes that the 5G system will involve front-haul, mid-haul as well as back-haul. These replacements have produced new requirements on fiber optical transceivers to experience the high-level Bandwidth and distance demands related to risky connections in the structure of 5G system.

For 5G Front-haul, 25G/100G Optical Transceivers: 25G Will Overpower:

The system of 5G needs high-level base-station, that’s why the requirement for high standard fiber optic transceivers will obviously become greater. It is believed that 25G/100G fiber optic transceivers must be the ideal solutions of the 5G optical transceiver front-haul system. In accordance with a description from EJL Wireless Research, the returns for the front-haul fiber optic transceiver trade will extend to $630 million in 2021, handled by shipments of 25G and 100G ORTX purposes providing support to great systems of MIMO 5G.

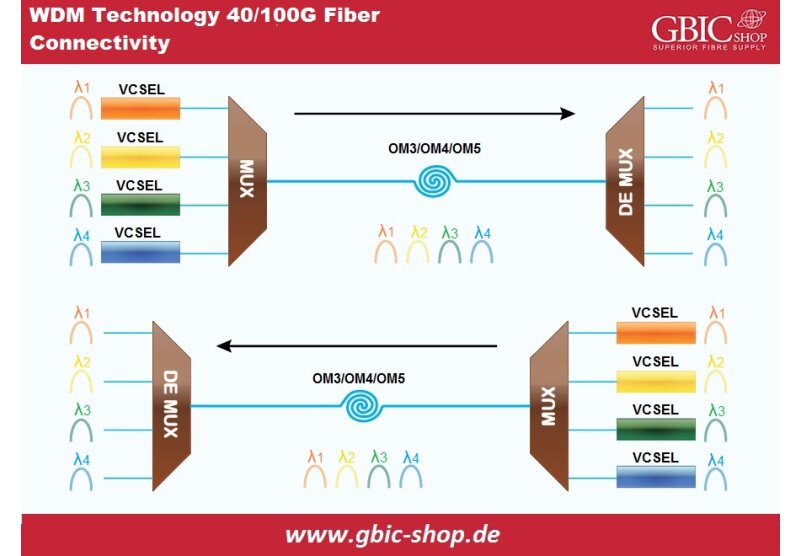

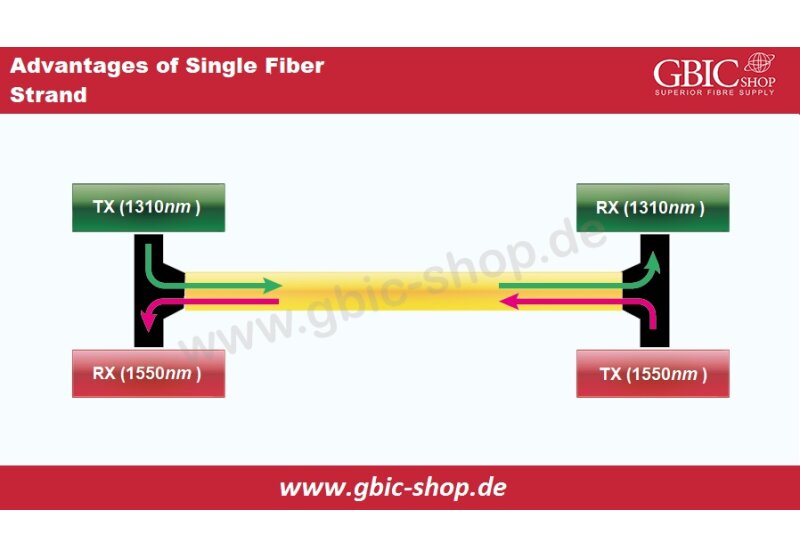

Like the Enhanced Common Public Radio Interface (ECPRI) interface protocol (usual rate 25.16 Gigabits) is utilized to transfer base-band sign of the base-station of 5G, the networks of 5G front-haul will considerably depend on 25G fiber optic transceivers. It is believed that the market value of the 25G optic module is expected to go to an amount of 2 million in 2021 as carriers operate to gain basic structures and techniques set to enable the shifting to 5G. Taking into consideration the 5G active antenna Unit (AAU) complete outside implementation conditions, 25G optical modules utilized in the front-haul system have to face the commercial temperature ranging from -40 degree centigrade - +85 degree centigrade, and dust-tight etc. Furthermore, 25G gray as well as color transceivers will be utilized in accordance with various front-haul structures implemented for 5G systems. Gray light modules 25G are much appropriate for fiber optical point-to-point straight interconnection systems because of the magnificent fiber riches. Whereas color light modules 25G are mostly placed in Passive Wavelength Division Multiplexing (WDM) and Active Wavelength Division Multiplexing/Optical Transport Networking (OTN) as they can give different AAU to DU links by utilizing one fiber optic. For further knowledge go through the 25G Transceiver Industry activated by 5G front-haul system.

The 100G fiber optical transceiver is also regarded as the better solution of the fiber optic front-haul system. The 100G optical transceiver, in 2019, in cooperation with 25G transceivers had been programmed for approved installments to rest still with the swift rapidity of 5G commercialized implementations and utilities. In systems of front-haul which need high-level speed , 100G PAM4 Dense Wavelength Division Multiplexing (DWDM) and 100G PAM4 FR/LR transceivers can provide support to 3-5 kilometers deprived of T-DCM and 20 kilometers with divided T-DCM and BBU expansion.

For 5G Mid-haul, 50G PAM4 Transceivers will be Dominant:

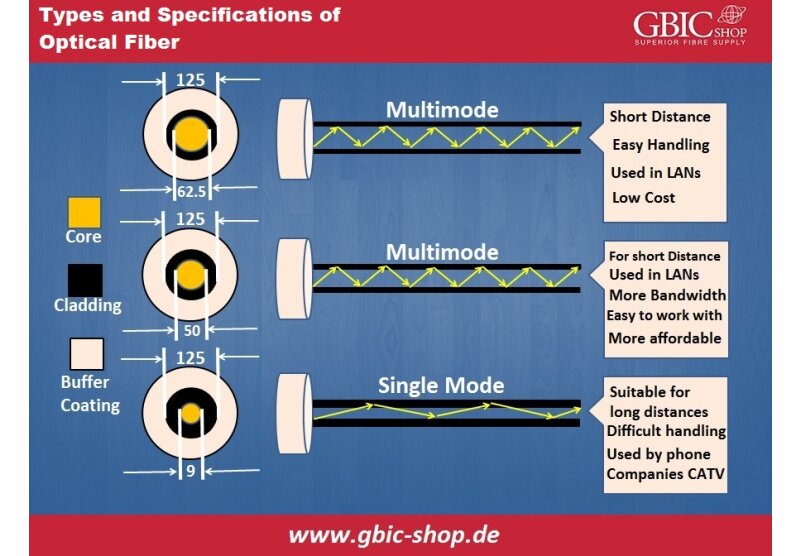

The 5G mid-haul system has demands for fiber optic transceivers at 50G Gigabits. Both the color as well as gray fiber optic transceivers can be accepted. Furthermore, the 50G PAM4 Quad Small Form-Factor Pluggable (QSFP) 28 optical transceivers, utilizing LC optical networking and SMF, will turn out exceptional for 5G mid-haul system as they provide an easy procedure to magnify the Bandwidth above a single-fiber connection deprived of fitting filters for WDM. They can provide support to 40 kilometers with divided BBU and DCM site expansion. The requirement for 50G fiber optic transceivers mostly approaches from the creation 5G weight-bearing system. It is anticipated that its market will extend to 10 million degrees if broadly accepted by the 5G load-bearing system.

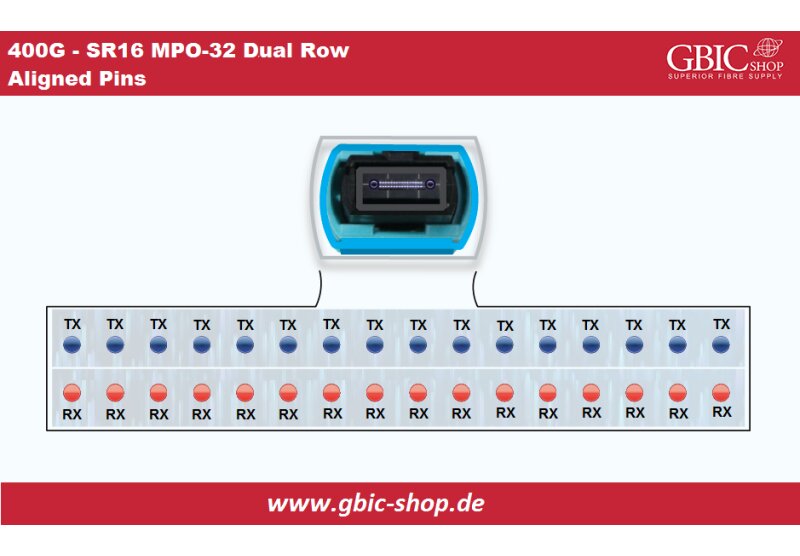

For Back-haul, 100G/200G and 400G Transceivers: The Most Crucial is 100G:

The 5G back-haul system will have to support more traffic in comparison to the 4G network because of the greater functionality and greater Bandwidth 5G New Radios. That’s why the accumulation surface and color coating of the 5G system have demands for 400 Gigabits, 200 Gigabits and 100 Gigabits rate Dense Wavelength Division Multiplexing (DWDM) color light transceivers. 100G PAM4 Dense Wavelength Division Multiplexing (DWDM) modules will be mostly implemented in the connection and accumulation surface which can provide support to 60 kilometers with divided T-DCM and fiber optic expansion. The core surface transportation demands great capability and increased distance of 80 kilometers, that’s why 100G/200G and 400G systematic DWDM optical transceivers are required to provide support to metro core Dense Wavelength Division Multiplexing (DWDM) systems. Currently the requirement for the 100G transceiver by the network of 5G is the most important and service suppliers will eventually demand 400G and 200G Bandwidth to attain the needed production for 5G implementations. It is believed that 5G back-haul transportation apparatus returns will extend to $3 billion near 2024 declared by Dell ’ Oro Group, which handles the increasing order for 100G/200G/400G optical transceivers.

From the second half of 2019, 5G commercialized utilizations have been conducted by China Telecom, China Mobile, China Unicom, SK Telecom, Korea Telecom, Verizon, LG U-plus, AT&T and T-Mobile. This has raised the requirement for fiber optics to a modernist record and produced significant chances for the transceiver industry. A statement from Research and Markets has anticipated that in 2020, the worldwide fiber optic transceiver industry vastness is expected to increase from USD 5.7 billion to USD 9.2 billion near 2025 increasing at a compound annual growth rate (CAGR) of 10.0 percent from 2020-2025.

IC Chipset for Fiber Optic Transceivers are Leading into a Fast- Growing Spell:

After some years of slow development, the industry for IC Chipsets utilized in transceivers is currently coming to a turning point. This is mostly managed by the large formation of 50 Gigabit Ethernet, 100 Gigabit Ethernet, 200 Gigabit Ethernet, 2x200 Gigabit Ethernet, 400 Gigabit Ethernet and 2x400 Gigabit Ethernet optical transceivers with PAM4 DSP chips utilized for 5G back-haul and mid-haul systems. A description from Light Counting states that the IC chipsets market utilized in transceivers is getting into a time of rapid development with a compound annual growth rate of 20% in 2020 to 2024. Trade of PAM4 DSP chipsets for programs in Ethernet optical transceivers and AOCs will concern for fifty percent of this market section near 2024. Powerful requirements for logical DSPs utilized in DWDM optical transceivers will also take part to the development.

The launch of 5G also uplifts the market of silicon photonics chips which is believed to present an extraordinary development in the time to come. In respect of market rate, the optical fiber waveguides, capturing a complete market quota of 45.4 percent, oppressed the worldwide silicon photonics industry in 2015. Moreover, it is believed to extend to a remarkable price in 2022, with a compound annual growth rate of 21.69 percent. With regard to the production department, the optical fiber transceiver industry occupied the leading share in 2015 and maintains to be on the topmost. When the rate of silicon photonics techniques is presenting a continual declination, its requirement has been greatly raising. Over time, companies such as IBM, Intel and Juniper Networks exhibited considerable concern and greatly put money in the silicon photonics chips industry for the purpose to energize their productions and to gain a big share in the market. For example, in 2016, Intel had presented its earliest 100G silicon photonics optical transceivers and by the end of 2019, Intel tried on its earliest 400G silicon photonics optical transceiver.

5G Manages the Development of Fiber Optical Wire and Coherent Cabling Markets:

Optical fiber is the better choice to keep pace with the requirement of 5G Bandwidth due to its extensibility, safety and capability to control a huge number of traffic with lesser attenuation. Moreover, it can provide limitless Bandwidth potentiality. In the basic structure of a 5G system, various fiber optic wires are needed to join micro central stations and end-points. This will be the basic element handling the development of fiber optic requirements. Moreover, 5G lower latency and great dependability programming schemes need superior calculating solutions which also demands for optical fiber wire placement. It is prudently anticipated that the complete fiber requirement is 350 million core km in 2020, with the requirement wanting to increase to 420 million core km in 2021. And the requirement for optical fiber is predicted to increase at a ratio of 20% in 2020 afterwards. The Asia Pacific area has come out as the biggest customer market of the optical fiber wire industry. In accordance with GSMA, 5G links are predicted to extend to USD 670 million in the Asia Pacific near 2025, calculating around 60 percent of the worldwide 5G links. The second biggest customer market is North America, accompanied by Europe.

Besides, fiber optic wires utilized for 5G systems should also be capable of controlling higher speeds and compactness, while at the same time decreasing latency, exhausting low energy and producing limited warmth. For the maintenance of these newly developed market requirements, global cable producers like Corning and Prysmian are working attentively in the progress of new and fresh fiber optic wires.

The utilization of 5G also provides great chances for the well-structured cabling industry. In the period of 5G, there will be further lines of work accepting organized wiring solutions to confirm their network security of IT appliances. In accordance with a current statement given by Fact.MR, the well –structured cabling industry developed at a compound annual growth rate of 6% from 2103-2017. The cost of the well-structured cabling industry was predicted to be almost USD 16 billion in 2018 and is predicted to record a compound annual growth rate of around 8% by 2028. Today, North America has the largest well-structured cabling industry. Nevertheless, the Asia Pacific is anticipated to be a fast-growing market of well-structured cabling.

5G Raises Requirement for Fiber Optic Examination Apparatus:

Fiber optic examination apparatus is the critical facilitator of 5G commercialized categorization which will support workers and apparatus distributors verify their software, hardware and customization to confirm they work as trusted and provide a magnificent consumer experience. Whereas the growing investment for 5G basic-structure, the requirement for apparatus to examine the 5G ecological system at the device, chipset, network surface and utilization layer parallels will be increasing. In accordance with Sullivan and Frost’s current survey, moved by the requirement for particular examinations to verify 5G based implements and chipsets, the worldwide industry for examining apparatus and solutions is anticipated to extend to $2 billion in 2024, increasing at a compound annual growth rate of 11.5 percent. The Asia Pacific area will be the largest revenue source for the worldwide optical fiber test apparatus industry with 42.8% of the complete 5G test industry revenue near 2024, accompanied by Europe and North America with shares of 18.1% and 33.8% respectively.

5G examining apparatus and solutions are required to compete with the network ideas and techniques evolved for 5G. There are five main capacities that optical fiber test apparatus should consider for 5G systems, which include data connection, higher Bandwidth, packet-based examining, network integration and ECPRI/IEEE 1914.3 (ROE).

Effects of Coronavirus on 5G:

2020 was expected to be the time of 5G. However, 5G deployment programs for network workers will be affected lightly by the sudden pandemic of coronavirus. Currently, the 3GPP has delayed the oncoming release of further 5G modules over three months because of the expansion of coronavirus. This will slightly detain the development of 5G-authorized product progress. Nevertheless, the prolonged tasks of 5G stay positive because it is the important base for the progress of virtual reality (VR), Internet of things (IOT), large data examination and further high Bandwidth utilizations.

Espaniol

Espaniol

Deutsch

Deutsch

English

English